Algorithmic Crypto Trading: Strategies, Bots & How to Start Dominating the Market

The crypto market is 24/7 active and highly volatile with rapid data flow and price shifts. This becomes often overwhelming for investors and traders. Emotions can cloud judgment, and opportunities vanish in milliseconds due to fall short of reaction time. This is where algorithmic crypto trading steps in, fundamentally transforming how we interact with digital assets.

Updated for mid-2025 realities, this comprehensive guide demystifies algorithmic crypto trading—what it is, how it works, benefits, cryptocurrency algorithmic trading strategies, key risks, and a practical path to selecting a platform and getting started

What is Algorithmic Crypto Trading?

At its heart, algorithmic crypto trading, often casually referred to as algo trading crypto or algorithmic cryptocurrency trading is simply the practice of using pre-programmed computer instructions, or crypto trading algorithms, to automatically execute buy and sell orders in crypto markets.

Think of these algorithms as highly sophisticated sets of rules and mathematical models. Their primary purpose is to analyze market data, swiftly identify opportunities, and perform trades with a speed and efficiency that no human could ever match.

In essence, it's about automation, surgical precision, and the systematic execution of a trading strategy, completely devoid of human emotion or fatigue.

How does Algorithmic Crypto Trading Work?

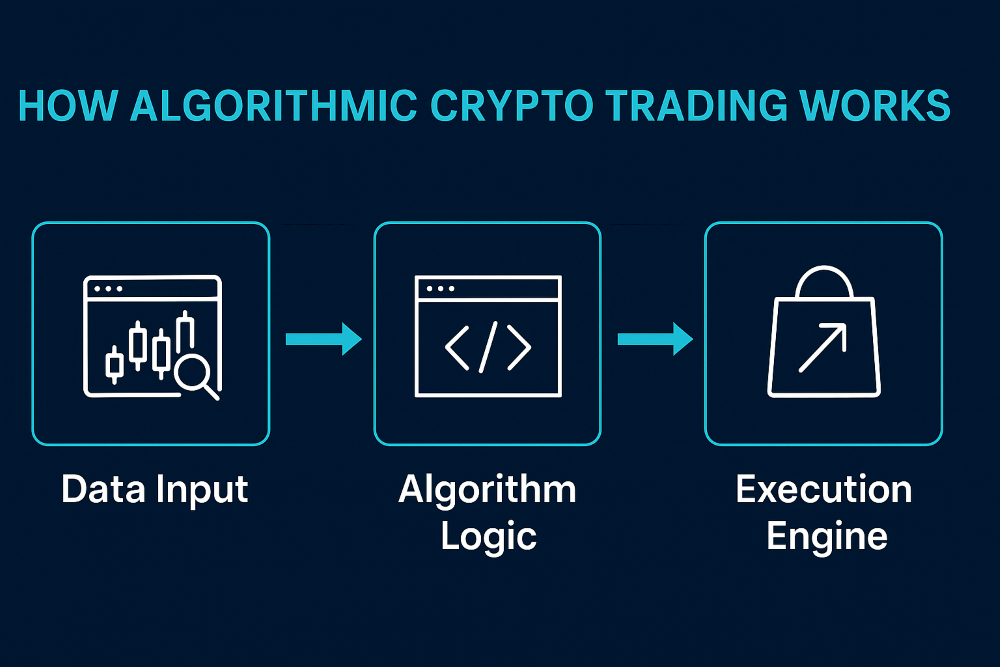

An algorithmic crypto trading system operates on a seamless, fundamental loop that leverages technology to automate both decision-making and trade execution. It's truly fascinating how interconnected these components are:

1. Data Input: The algorithm is like a perpetual student, constantly absorbing real-time market data. This isn't just about price feeds; it includes crucial details like trading volume, the depth of the order book, and even sentiment analysis derived from news and social media, all specific to the crypto exchanges it's operating on.

2. Algorithm Logic: This is where the real intelligence of the system resides. Based on a predetermined set of rules (those familiar "if/then" conditions), complex mathematical models (perhaps statistical arbitrage models), or increasingly, advanced machine learning models, the crypto trading algorithm meticulously analyzes all that incoming data. It diligently searches for specific patterns, deviations, or conditions that strongly signal a trading opportunity, all according to its precise programmed strategy.

3. Execution Engine: Once a valid trading signal lights up, the algorithm's execution engine springs into action. It seamlessly connects to crypto exchanges via Application Programming Interfaces (APIs), then automatically places the desired orders (whether market, limit, or stop-loss) to buy or sell the cryptocurrency. All of this happens without any manual intervention, often within mere milliseconds.

This entire process, from data ingestion to order placement, is a testament to the high-speed, seamless nature that makes algorithmic trading crypto so incredibly powerful in today's highly volatile digital asset markets.

What are the Benefits of Algorithmic Crypto Trading

The advantages of using a crypto trading algorithm are truly compelling, nicely overcoming most of the inherent shortcomings we face as human traders.

- 24/7 Market Access: Unlike the traditional stock markets, the crypto market doesn't close. What that means is your algo trading cryptocurrency platform can operate all day and all night, monitoring market conditions 24/7 and making trades even while you're sleeping. It's all about capturing those surprise moves that can occur while you're not actively trading.

- Superior Speed and Efficiency: In high-frequency domains, microseconds matter. Algorithmic trading crypto platforms can respond to market dynamics and make trades in fractions of a second, a scorching pace that's simply out of the question for even the best human trader. This kind of accuracy is totally vital for cashing in on transient arbitrage opportunities or picking up sudden trend reversals.

- Removal of Emotional Bias: Fear, greed, and panic are notorious drivers of irrational trading decisions. Cryptocurrency trading algorithms are completely immune of these human emotions, however. They strictly follow orders, exercising disciplined and remarkably consistent action regardless of how sentiment in the market can change. Such resolute objectivity frequently prescribes firmer and perhaps more profitable outcomes.

- Accuracy & Precision: Algorithms execute trades exactly as directed, reducing human error in placing orders, calculations, or monitoring. That type of accuracy is invaluable, especially in the case of complex strategies with several conditions or numerous concurrent trades.

- Backtesting and Optimization: Without ever risking a single penny of real capital, algorithmic crypto trading allows you to rigorously test your crypto algo trading strategies against vast levels of historical data. This critical process, known as backtesting, helps you determine any likely weaknesses, optimize parameters with extreme care, and build genuine confidence in your strategy's potential.

What are the Best Algorithmic Crypto Trading Strategies

Crypto algorithmic trading strategies are exquisitely diverse, each being designed to exploit different market situations and underlying inefficiencies. Mastering these basic strategies is essential in order to be able to use algorithmic cryptocurrency trading systems effectively.

1. Momentum Trading

Momentum, or trend following, remains a core strategy in algorithmic crypto trading. It is based on a simple premise: stocks trending strongly in one direction are most likely to continue doing so for some measurable duration.

A crypto trading algorithm bot can recognize these trends from popular technical indicators like moving averages (e.g., 50-day and 200-day moving average crossover), the Relative Strength Index (RSI), or the Moving Average Convergence Divergence (MACD).

The trading bot algorithm then buys when an uptrend is firmly established and sells (or short-sells) when a downtrend is firmly established, with well-set predetermined stop-loss and take-profit.

If you prefer pre-built options, explore automated trading bot cryptocurrency and customize safely before going live.

2. Mean Reversion

In direct contrast to momentum, mean reversion systems rely upon the assumption that asset prices, after having strayed significantly from their norm, will revert to the norm. Algo trading crypto strategy' algorithms typically utilize tools such as Bollinger Bands or mean standard deviation to pinpoint those moments of "overbought" or "oversold.".

For example, if the price of a crypto dips way below its historical average, the algorithm can invest in it and hope to catch the bounce back. It can sell when it goes too high, hoping for a pullback.

One common and effective application here is "pairs trading," in which two typically correlated assets are purchased and sold when their correlation temporarily breaks down.

3. Arbitrage Trading

Arbitrage is the classic strategy of simultaneously buying and selling an asset in different markets to instantly profit from a minute price discrepancy. In algorithmic crypto trading, this most often involves exploiting those minuscule price differences for the same cryptocurrency across various crypto exchanges.

Given the blistering speed required, high-frequency crypto trading algorithms are absolutely essential here. Imagine Bitcoin is priced at $30,000 on Exchange A and $30,005 on Exchange B; an arbitrage bot would instantaneously buy on A and sell on B, pocketing that quick $5 difference (minus fees). This concept can even extend to "triangular arbitrage," involving three different cryptocurrencies.

Learn more about crypto arbitrage trading here in our detailed guide.

4. High-Frequency Trading (HFT)

High-Frequency Trading (HFT) is not a strategy in itself, but rather a very technical subset of algorithmic crypto trading that is characterized by extremely high execution speeds, rapid order submission and cancellation, and extremely short holding horizons for positions.

HFT crypto trading algorithms rely on leading-edge hardware, ultra-low-latency connectivity, and even premier co-location services (placing servers close to the exchange server location) in an effort to capture a worthwhile millisecond margin.

Although most often applied to such tactics as arbitrage, HFT is also applied to take advantage of savvy market making or even fleeting, extremely temporary trends. It's a notoriously competitive, highly technical domain, often requiring significant investment.

5. Grid Trading

Grid trading is one of the most renowned crypto algo trading strategy that initiates a series of buy and sell limit orders strategically above and below a specific price at regular intervals. It's smartly designed to profit from volatile, ranging markets (keep sideways movement in mind) rather than strong, directional trends. The bot will buy automatically when the price drops to either of the levels at which the buy order has been placed. Or, when a sell level order is reached, it sells.

This simply leaves a grid of orders. The crypto trading algorithm continues to adjust these orders, hoping to make tiny, incremental gains as the price oscillates within that defined order grid. While very simple to execute, note that grid trading can generate enormous losses if the price were to break out of the established trading range and not return.

6. Machine Learning (ML) and AI-Driven Strategies

The combination of Machine Learning (ML) and Artificial Intelligence (AI) has a revolutionary impact on algorithmic crypto trading. Traditional algorithms stick to set rules, but AI/ML models can study huge amounts of past and current data, spot complex non-linear trends, and change their plans as needed. This gives them great power to create advanced algorithmic crypto trading strategies.

Your crypto trading algorithm can study market actions to find the best times to buy and sell, predict price changes more , and even adjust how much risk it takes. This goes beyond basic "Naive Bayes" models to include deep learning, reinforcement learning, and neural networks.

ML Applications:

- Predictive Analytics: AI looks at tons of data (price, volume, on-chain metrics) to guess future price changes.

- Sentiment Analysis: Using Natural Language Processing (NLP), AI keeps an eye on news social media, and forums to measure how people feel about the market and guess how this will affect crypto prices

- Adaptive Strategy: AI models can make themselves better always fine-tuning their rules based on how well they're doing, getting around the limits of unchanging algo trading crypto strategies.

7. Order Chasing

Order chasing is a more advanced crypto algo trading strategy whereby the algorithm attempts to detect and profit from large, secretive, institutional orders (sometimes referred to as "dark pool" activity. Although true dark pools are less common in crypto compared to traditional finance.

By reading subtle patterns in order book depth, trade sizes, and spread changes, the algorithm tries to predict the direction of an impending large trade and position itself to profit from the subsequent price movement.

While this strategy requires very sophisticated data analysis and speed of execution, it is mostly legal as long as the information is gathered from publicly available information and not from illegal sources or insider information.

What are the Risks and Challenges of Algorithmic Crypto Trading

Despite its huge potential, algorithmic crypto trading comes with its fair share of significant risks and challenges that all trader must know:

- Overfitting & Backtesting Bias: A crypto trading algorithm can perform exceptionally well in historical data (backtesting) but badly in actual live markets. This "overfitting" occurs when the algorithm is catching some historical noise instead of generalized market trends. This process is not free from risks, like overfitting. This can occur when a bot trained on a basis of historical data can't reflect the present market state and the strategy may not be capable of delivering the profits that the user expects. Market circumstances constantly evolve, and previous performance is no indication of future success.

- Technical Glitches & System Failures: Algorithms rely on complex software and on robust infrastructure. Software bugs, internet connectivity issues, API downtime from exchanges, or server issues can lead to incorrect trades, missed trades, or even significant losses.

- Market Volatility & Black Swan Events: While algorithms thrive on volatility, intense, unexpected market fluctuations (e.g., flash crashes, unexpected regulation changes, or massive hacks) might take even the most excellent algorithmic crypto trading strategy by surprise, leading to rapid, substantial losses.

- Security Risks: Algorithmic crypto trading platforms and bots require access to your crypto exchange accounts via API keys. If those keys get hacked or the platform gets hacked, your funds could be at risk.

- Cost & Complexity: Developing, deploying, and maintaining complex crypto trading algorithms can be costly, involving high technical expertise, data subscriptions, and potentially outrageous platform fees.

What are the Legal and Regulatory Considerations for Crypto Also Trading

The rules and laws for algorithmic crypto trading are new and differ a lot between countries. You can use trading algorithms , but you need to know about:

- Anti-Manipulation Laws: It's against the law to use algorithms for wash trading, spoofing, or pump-and-dump schemes. You'll face big fines if you do.

- Licensing Requirements: Some places might make you get special permits to run automated trading systems if you're a pro or a big company.

- Tax Implications: You'll have to pay taxes on the money you make from algorithmic crypto trading. This could be capital gains or income tax, depending on where you live.

- KYC/AML Compliance: Crypto exchanges make all users, including algo traders follow Know Your Customer and Anti-Money Laundering rules.

To stay out of trouble with the law, you need to keep up with the changing rules in your area.

How to Start Algo Trading for Crypto: Your Step-by-Step Guide

Starting your algorithmic crypto trading journey requires a structured approach. Follow these steps to maximize your chances of success:

Step 1: Choose a Crypto Algo Trading Platform

Look for platforms with robust APIs, security features, backtesting tools, and support for your preferred exchanges.

Key Factors to Consider When Choosing a Best Crypto Algo Trading Platform

- Ease of Use: Is it beginner-friendly or designed for experienced coders?

- Supported Exchanges: Does it connect to the crypto exchanges where you hold your assets?

- Available Strategies & Customization: Does it offer the crypto algo trading strategies you're interested in, or the flexibility to build your own?

- Pricing/Fees: Understand subscription models, performance fees, or transaction costs.

- Backtesting & Paper Trading Features: Essential for testing strategies safely before live deployment.

- Security Features: Look for robust security protocols (API key encryption, 2FA, whitelisting).

- Customer Support & Community: Access to help, tutorials, and a supportive community can be invaluable.

Step 2: Design or Select a Strategy

Start with proven strategies (momentum, arbitrage, grid) or use pre-built bots. You must have a clearly defined trading goals when choosing your strategy such as consistent small gains, profiting on major trends etc.

Step 3: Backtest Your Algorithm

Never deploy a live crypto trading algorithm without thorough testing. Use historical data to test your strategy's performance and tweak as needed.

Step 4: Set Up Risk Management

Define stop-losses, take-profits, and position sizes. AI crypto trading bots can even use adaptive stop-loss orders. Never invest more than you can afford to lose. Don't put all your capital into one strategy or asset.

Algorithms are not "set-it-and-forget-it" tools. Regularly monitor performance, market news, and regulatory updates, adjusting your strategy as needed.

Step 5: Deploy Live

Start trading with a small amount, monitor performance, and scale up as you gain confidence.

Is Algorithmic Crypto Trading Profitable?

Yes, algorithmic crypto trading can be highly profitable, but profitability is by no means guaranteed and varies considerably. Its potential arises from speed, accuracy, and emotionless execution. But it all depends on a few critical factors such as;

- Effective Strategy: The quality and adaptability of the crypto algo trading strategies you employ.

- Market Conditions: What works in a bull market might not work in a bear or sideways market.

- Proper Implementation: Flaws in code, misconfigurations, or technical issues can lead to losses.

- Rigorous Testing & Optimization: Only well-researched and well-tested crypto trading algorithms have a chance of long-term profits.

- Disciplined Risk Management: Even profitable strategies can cause huge losses if they are poorly controlled for risk during unforeseen market events.

Algorithmic trading crypto gives one the tools to be a step ahead, but it's not a "get-rich-quick" scheme. It requires steady effort, learning, and adaptation. Therefore, if we are answering "Can you make money with algorithmic trading?", then yes, but it will require expertise and dedication to implement.

How to Select the Best Crypto Trading Algorithm

There is no single "best crypto trading algorithm" or "strongest crypto algorithm" that works universally across all market conditions and for all traders. The "best" algorithm is subjective and entirely depends on:

- Market Environment: A trend-following algorithm might thrive in a strong bull market but struggle in a choppy, sideways market. Conversely, a mean-reversion algorithm might excel in ranging markets but suffer in strong trends.

- Trader's Risk Tolerance: High-frequency arbitrage might yield consistent small gains but requires significant capital and technical prowess, while a longer-term trend-following algorithm might have larger drawdowns but fewer trades.

- Available Capital: Some strategies, like market making, require substantial capital to be effective.

- Specific Assets: For bitcoin algorithmic trading, deeper liquidity and tighter spreads generally allow stricter slippage and fill conditions, while illiquid altcoins may require wider thresholds and smaller position sizes. For algo trading bitcoin, prioritize low-latency connectivity, fee-tier optimization, and multi-venue routing.

The most effective crypto algorithm trading systems are often those that are continuously monitored, refined, and adapted by an experienced trader, or those that leverage advanced AI/ML capabilities to learn and adjust. Diversifying across different strategies is often more robust than relying on a single "strongest" one crypto algorithms do work in executing trades

FAQs - Algorithmic Crypto Trading

Here are answers to some of the most common questions about algorithmic crypto trading.

How much can algo traders make?

Revenues of algo traders vary tremendously, from big profits to big losses. Factors are the amount of capital employed, the complexity and effectiveness of their algorithmic trading cryptocurrency strategies, risk management techniques, and market conditions in general. It's a competitive market, and consistent profitability requires expertise and continued effort.

Do crypto algorithms work?

Yes, crypto algorithms can certainly because they are capable of performing trades as per pre-designed rules effectively and without any human error. Their ability to generate profits, is entirely dependent upon the quality of the underlying crypto trading algorithmic strategies, market evaluation, rigorous backtesting, and risk management. A structured and well-organized algorithm can actually work to accomplish defined trading objectives.

Can I use AI to trade crypto?

Yes, you can most certainly trade crypto with AI, and it is a very strong and popular way. Artificial Intelligence (AI) and Machine Learning (ML) are being integrated into algorithmic crypto trading platforms so that there can be more robust features.

AI algorithms can handle enormous sets of data, identify complex patterns, conduct sentiment analysis of social media posts and news, and even adjust algorithmic crypto trading strategies in real-time, which provides a significant edge to AI-based systems over rule-based systems. Many AI crypto trading bots are now available for beginners as well as advanced users.

Are trading algorithms illegal?

No, trading algorithms are not illegal. They are widely used by financial institutions, hedge funds, and individual traders globally. Legality shifts when algorithms are used to facilitate illegal activities such as market manipulation (e.g., wash trading, spoofing, front-running on non-public information). That is strictly forbidden regardless of whether it's a human or an algorithm performing them. As long as they follow fair trading principles and rules of the market, trading algorithms are acceptable.

What are the best profitable high volume crypto trading strategies?

On high-liquidity pairs, proven approaches include momentum/trend-following, market-neutral arbitrage (venue or triangular), and grid for well-defined ranges. Pick one, codify risk limits (SL/TP, max drawdown), and backtest across multiple regimes. For a broader overview, see crypto trading strategies

Conclusion

Algorithmic trading crypto has shifted the paradigm of traders and institutions approach in crypto trading. With crypto trading algorithms speed, precision and emotionless decisions power, traders can now navigate the volatile crypto market with unparalleled efficiency.

While the profitability chances with algorithmic trading Bitcoin and other assets are more real than ever before. But its also important to understand that these are powerful tools, but not magic wands.

Algorithmic trading crypto success requires continuous learning, meticulous testing, disciplined risk management, and a deep, understanding of dynamics of the market. So, start your journey of algorithmic crypto trading very wisely.

For those who are in search of expert trading strategies without getting into the complexities of direct management, Zignaly Profit Sharing is an innovative and advance model. It offers a truly hassle-free trading platform to grow your crypto portfolio, with professional traders managing pooled funds and earning only when you profit.